While doing business the payment part is always integral. It’s the cornerstone of each business and understanding the process is paramount. There are few things to consider when choosing payment methods accepted to your business. These include the location or country, payment mode credit card, or online. Shopify Payments is available only to stores in certain countries and regions. With Shopify Payments, you’re automatically set up to accept all major payment methods as soon as you create your Shopify store.

When you set up a payment provider to accept credit card payments, each payment must be processed, so there is usually a delay between when the customer pays for their order and when you receive the payment. After the payment is processed, the purchase amount will be transferred to your merchant account.

Credit card Shopify Payment

Credit card processing is done for you by your payment provider. This process has the following stages:

- Authorization: checks with the issuer to make sure the credit card is valid. If the card is valid and has enough funds, then the issuer authorizes the payment

- Capture: After the payment is authorized, the payment has to be captured. When a payment is captured, details about the payment are sent to the acquiring

- Clearing: The acquirer reviews the payment details, and then requests the necessary funds from the company that processes the customer’s credit card.

- Funding: The acquirer subtracts a small fee from the amount, and then transfers the final amount to your merchant account.

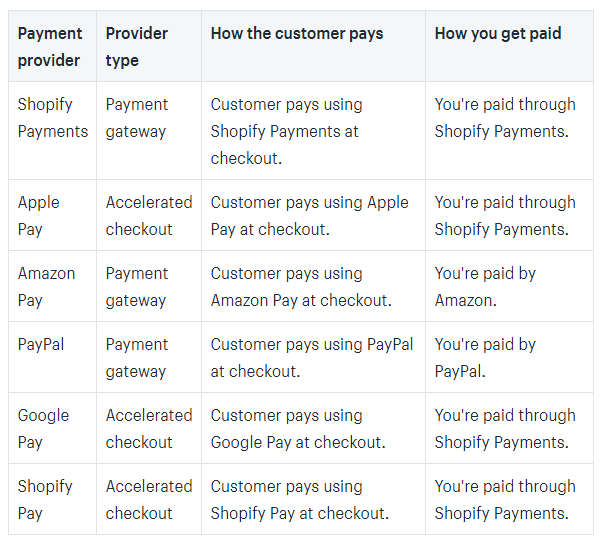

Other payment providers, such as PayPal, will have their own ways of getting funds from your customer to you. Check with the service you are using to find out how they will pay you. You can accept manual payments outside of your online checkouts, such as money orders or bank transfers.

PayPal Shopify Payment

PayPal is one of Shopify’s default payment providers. As soon as you open a store, you’re given a PayPal Express Checkout account with the email you used to sign up for your Shopify store. Before you can collect payments for orders made with PayPal, you need to set up your PayPal account. Before we get into how to set up a PayPal account, you need to decide which kind of PayPal account you want to make. There are two types: personal and business

Setting up a PayPal account

- Visit PayPal’s website and click the Sign-Up button in the top-right corner.

- Select the account type you want — Personal or Business — and click Continue.

- Add in your name, email address, and password, and then click Continue.

- Add in your address and other required info, and then click Continue.

- Click the blue Get started button, add in your credit card info, and click Add card.

- Verify your email address by clicking the link in the email sent to you by PayPal.

If your store has Shopify Payments enabled, then you receive payments through Shopify Payouts when a customer pays using Shopify Payments and specific accelerated checkouts. If customers pay using third-party payment gateways, then you won’t see your payout information in your Shopify admin.

Manual Shopify Payment

Some customers don’t want to pay for their orders using a credit card. These customers can still place their orders online if you set up a manual payment method. When your customers use a manual payment method, you can arrange to receive their payment outside your online checkout.

After you receive the payment, you can then manually approve the order. Common types of manual payments include cash on delivery (COD), money orders, and bank transfers. Orders that accept manual payments are marked as unpaid on the Orders page.

After you receive payment for a customer’s order, you can mark the order as paid on the order details page and fulfill the order as you would if they had made an online payment.